Editor’s note: This post has been updated with new information.

Southwest Rapid Rewards Plus Credit Card Overview

The Southwest Rapid Rewards Plus Credit Card is the cheapest Southwest credit card on the market, which is either a strength or weakness depending on how you look at it. While the $69 annual fee is nice and low, the Plus card doesn’t have many perks to keep you interested past the initial welcome bonus. Card Rating*: ⭐⭐⭐½

*Card Rating is based on the opinion of TPG’s editors and is not influenced by the card issuer.

In a hobby now dominated by ultra-premium credit cards with $450-plus annual fees and a laundry list of luxury perks, it’s hard to imagine that a cobranded airline card with a $69 annual fee might be valuable to loyal Southwest customers, but the Southwest Rapid Rewards Plus Credit Card does make sense for some flyers — under the right conditions.

Southwest is already relatively unusual in that it offers three affordable personal credit cards. With all three cards offering an identical 30,000-point sign-up bonus and a coveted Southwest Companion Pass (good through February 28, 2023) after meeting minimum spend requirements, it’s even more important to look at the differences between your three choices. Fortunately, Southwest has just added a few more perks to their Rapid Rewards Credit Card collection.

Let’s take a look at how the Southwest Rapid Rewards Plus Credit Card measures up.

New to The Points Guy? Want to learn more about credit card points and miles? Sign up for our daily newsletter.

In This Post

Who is this card for?

This is not the card that’s going to unlock the doors of fancy, first-class suites or give you all the trappings of elite status, but that’s never been what Southwest is about. The Southwest Rapid Rewards Plus offers a modest earning rate and minimal benefits, but if you’re only flying Southwest occasionally, that’s really all you need.

That said, it’s important to keep in mind that the Southwest Rapid Rewards Plus is subject to Chase’s 5/24 rule. If you’ve opened five or more new credit card accounts (including being added as an authorized user) in the past 24 months, you more than likely won’t be approved for this card. If you are under 5/24, remember that opening this card will count toward that score, so make sure this will be worth that slot.

There’s another limitation, though. If you currently hold any personal Southwest credit card — or earned a sign-up bonus on a personal Southwest card in the last 24 months — you won’t be eligible for the bonus on this card. Fortunately, this restriction is just on personal cards and doesn’t apply to Southwest business cards. This means you can have both a personal and a business card open simultaneously, which is something you might want to do (more about this below).

Related: Battle of the airlines: Why I think Southwest Airlines is the best

Southwest’s newest credit card offer: the Companion Pass

Whether you settle on the Southwest Rapid Rewards Plus Credit Card or opt for one of its siblings (the mid-tier Southwest Rapid Rewards Premier Credit Card or the top-tier Southwest Rapid Rewards Priority Credit Card), you’ll earn the same sign-up bonus.

With this unique offer, you’ll earn 30,000 points after you spend $5,000 on purchases in the first three months your account is open, plus a Companion Pass (good through February 28, 2023). The Companion Pass is one of the most coveted airline benefits available, though it’s usually difficult to acquire. This pass allows the card holder to bring along their companion on any Southwest flight, booked either by cash or points, by just paying any taxes and airline fees.

TPG values Southwest Rapid Rewards points at 1.5 cents each, making this point sign-up bonus worth $450 alone.

But the value of the Southwest Rapid Rewards Plus Credit Card can be stretched even further with the valuable Southwest Companion Pass — which is potentially worth thousands of dollars depending on how often you and a partner fly. If most of your travel is solo — even if you travel every week — the Companion Pass will most likely not provide you much value. But if you have a child or significant other and you’re looking to hit the skies often over the next 12 months, this pass can be invaluable.

For instance, let’s say you and your partner are looking to fly once a month, and the round-trip cost averages $250. With this buy-one-get-one pass, your partner will be saving a whopping $3,000 on flights per year solely due to the Companion Pass perk. While you’ll pay the taxes and fees on your companion’s ticket, for domestic flights, you are looking at a minimal $5.60 per one-way flight. International flights can cost more depending on the destination.

Prior to the sign-up bonus, flyers would need to acquire 125,000 points (or fly 100 one-way flights with Southwest) in a calendar year to earn the pass. However, travelers can now earn the pass by meeting the $5,000 spending requirement within three months of opening a Southwest credit card.

Read more: 13 lessons from 13 years’ worth of Southwest Companion Passes

Main perks and benefits

The value of the Southwest Rapid Rewards Plus card doesn’t just stop at the sign-up bonus. Here are all of the perks you’ll get in exchange for a $69 annual fee:

- New: 2 EarlyBird check-ins every card anniversary.

- Annual 3,000 bonus points on your account anniversary, worth about $45.

- Baggage delay insurance: Up to $100 a day for up to three days when your bags are delayed more than six hours.

- 25% back on inflight purchases on Southwest Airline flights

- Extended warranty protection: Up to one year added to eligible manufacturers’ warranties of three years or less.

- Purchase protection: Up to $500 of damage or theft coverage for 120 days for eligible purchases you make on your card.

Earning and redeeming

Here’s the new earning rate on the Southwest Rapid Rewards Plus card:

- New: 2 points per dollar on local transit and commuting purchases, including ride-hailing services.

- New: 2 points per dollar on internet, cable, phone services, and select streaming service purchases.

- 2 points per dollar on Southwest purchases and those made with Rapid Rewards hotel and car rental partners.

- 1 point per dollar on all other eligible purchases.

The addition of these new bonus categories helps the Southwest Rapid Rewards Plus Credit Card be a forerunner for everyday purchases.

While most of Southwest’s route network is concentrated on domestic U.S. flights, be warned that the Southwest Rapid Rewards Plus Credit Card does have a 3% foreign transaction fee.

Rapid Rewards offers a few low-value redemption options, including gift cards, merchandise, hotel stays, rental cars, and travel experiences. You can even redeem for international flights on other carriers — but for all of these options, the rates are worse than what you’d get by redeeming for Southwest flights. And of course, with the Companion Pass, your points are worth twice as much when you use them for Southwest flights.

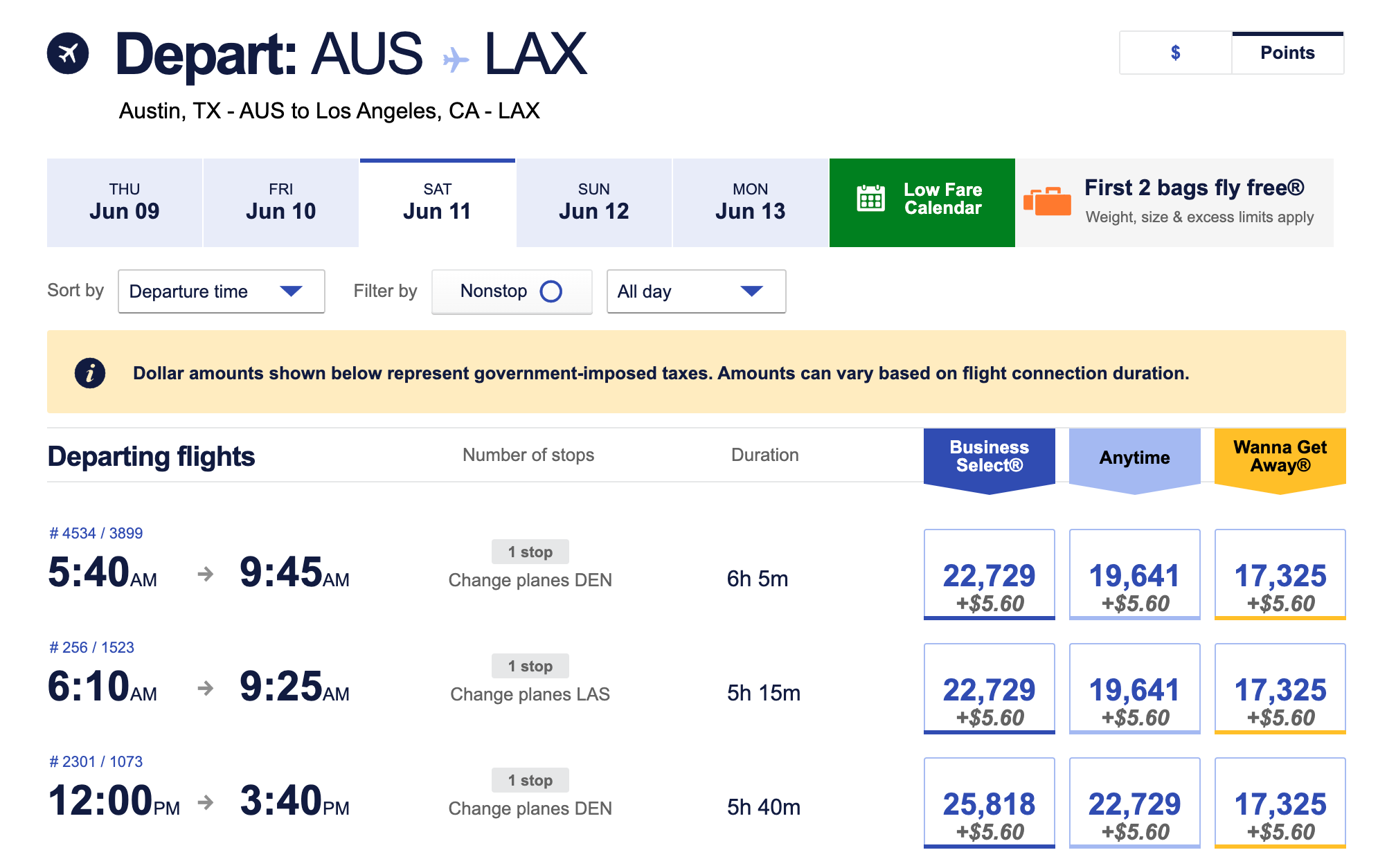

The airline offers three tiers of fares, ranging from the cheapest Wanna Get Away tickets to the more expensive Business Select ones.

The award rates are tied to the cash price of the tickets, unlike other airlines that use fixed-value charts. This means you don’t have to worry too much about saving up for a good redemption opportunity. If you have Rapid Rewards points, it’s almost always a good idea to use them instead of holding them for future redemption.

Related: How to redeem points with the Southwest Rapid Rewards program

How does the Southwest Plus card stack up?

The most obvious competitors to the Southwest Rapid Rewards Plus Credit Card are the Southwest Rapid Rewards Premier Credit Card and the Southwest Rapid Rewards Priority Credit Card. The Premier has a slightly higher annual fee of $99, plus a better anniversary points bonus (6,000 points) and higher earning rate on Southwest purchases (3 points per dollar vs. 2 points per dollar), as well as no foreign transaction fees.

If you’re interested in getting more out of your Southwest credit card, you should set your sights on the top-tier Priority Card. Your $149 annual fee is effectively cut in half thanks to a $75 annual Southwest travel credit. The Priority card also has a 7,500-point anniversary bonus, all other benefits from the previous two cards, four upgraded boardings per year, and the ability to earn unlimited TQPs toward elite status.

The question you ultimately need to answer for yourself is whether you want the cheapest card – or if you are willing to pay more money upfront and essentially have it returned to you in the form of Southwest travel credits and anniversary points bonuses.

Related: Comparing the Southwest Rapid Rewards Priority, Premier, and Plus credit cards

Bottom line

For only $69 per year, this card comes with one of the best sign-up bonuses we’ve seen from the Southwest card lineup. The ability to earn 30,000 points and a Companion pass is enough to make this card worth considering, especially for those who like Southwest but only fly with the airline occasionally.

Official application link: Southwest Rapid Rewards Plus Credit Card with 30,000 bonus points and a Companion Pass.

Additional reporting by Stella Shon and Christina Ly.

Featured photo by John Gribben for The Points Guy.