Editor’s note: This post was updated with additional details.

Unlike many people who work at TPG, I was hired as a news reporter despite not knowing much about points, miles or loyalty programs.

As a result, I’ve spent the past 10 months (and counting) learning on the job about the intricacies of the travel hacking world. It’s been a steep learning curve.

This points game is complicated. The information is fluid, and loyalty rewards programs change constantly. We see limited-time offers from rewards credit cards with big welcome bonuses, and then, before you know it, those offers disappear or change.

And don’t even get me started on transferable points currencies — there are more partnerships than any one person can keep up with.

It’s information overload, and it’s enough to give some newbies (this author included) headaches.

Prior to working at TPG I only ever had a Southwest Rapid Rewards credit card. I used Rapid Rewards points for most of my domestic redemptions, and I always paid cash for international travel. However, at TPG I’ve learned there are occasions where it makes more sense to pay cash for domestic flights and save up my points for more aspirational trips.

Here are nine lessons I’ve learned so far.

For more TPG news delivered each morning to your inbox, sign up for our daily newsletter.

In This Post

Sign up for any and all loyalty programs

Prior to joining TPG, I did not have a loyalty account with any program besides Southwest Airlines. This was silly on my part, since loyalty programs offer various perks, including some that award bonus points simply by signing up or by completing a first qualifying activity.

Hilton Honors, Marriott Bonvoy and Alaska Airlines Mileage Plan are among the loyalty programs currently offering freebies for new members, ranging from points to miles to travel credits.

Before you book a flight or a hotel reservation, see if the brand has a loyalty program you can sign up for. If you forget to add your loyalty number at the time of booking, try doing it during check-in or reaching out to the program afterward to see if they will retroactively credit you for a flight or a hotel stay. (I have done this successfully with World of Hyatt.)

It takes time to accrue enough credit card points for great redemptions — and the same is true for points earned through loyalty programs. But over time, you’ll hopefully earn enough points and miles to cover the costs of some free trips.

Entry-level status doesn’t get you much

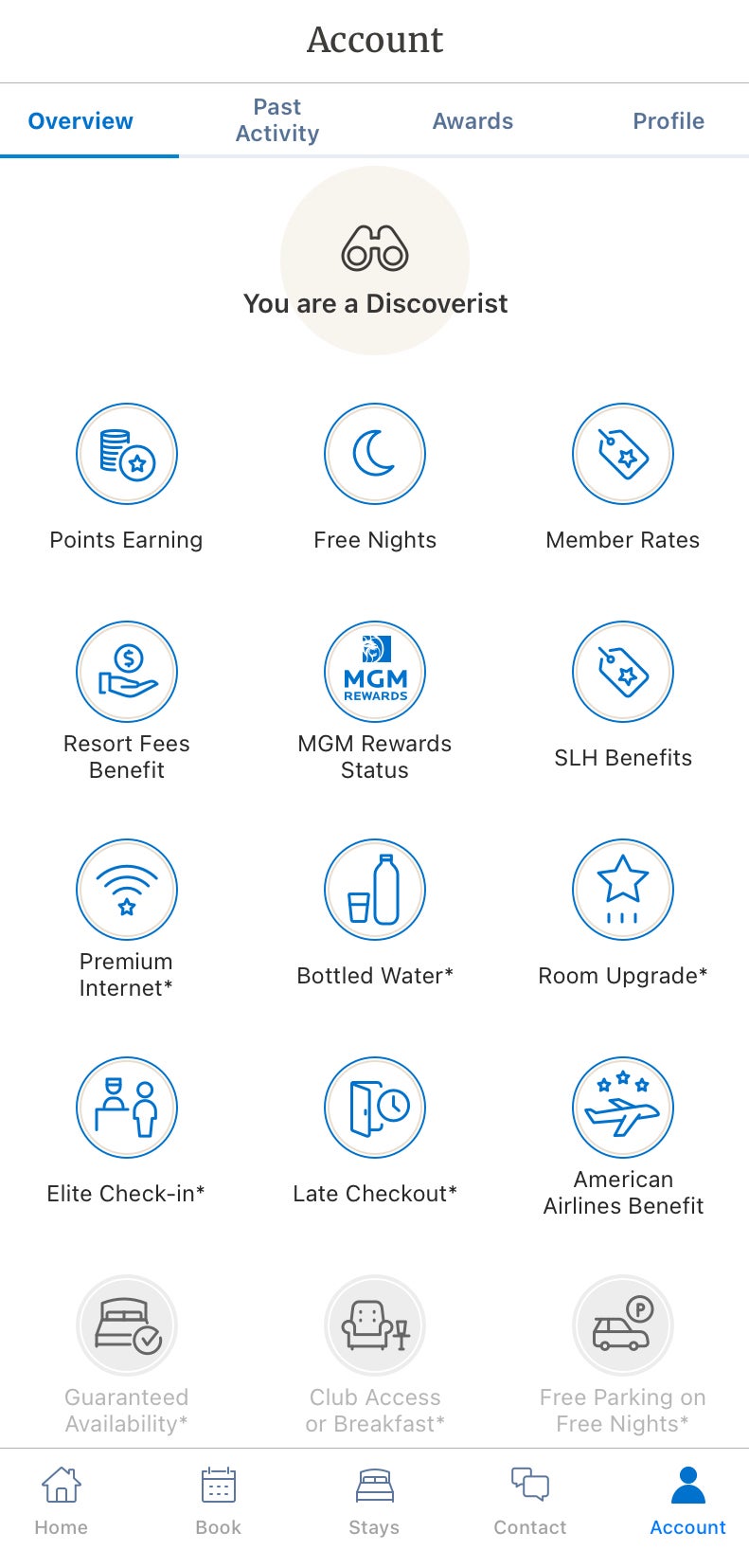

I obtained Gold American Airlines AAdvantage status last year, much to my excitement. In addition to my AAdvantage Gold status, I became a World of Hyatt Discoverist last July.

I expected to receive upgrades as a result of holding status for each program, but I have not experienced any so far (excluding one upgrade to first-class on a regional American flight last month from St. Louis to Chicago).

Even though obtaining entry-level status means you’re heading in the right direction with points accumulation, don’t expect to get too much in return.

As an AAdvantage Gold member, I’m eligible for complimentary upgrades on American flights, but I’m not anticipating this to be a regular occurrence because status upgrades are granted in descending order from highest to lowest status holder. Therefore, I will likely only be upgraded if there are still seats unsold within the 24-hour period before a flight’s departure.

Outside of flight upgrades, Gold members are eligible for better seats, either in the preferred area of an aircraft or a Main Cabin Extra seat with extra legroom on American. I also get to board with Group 4, which is earlier than I would board without status.

Out of all of the benefits I’ve received thus far from my Gold status, I’ve enjoyed the preferential seat selection most.

For hotels, my experience as an entry-level Hyatt status holder has been similar. I’ve received one room upgrade thus far when staying at the Hyatt Centric in Chicago’s South Loop in January.

Upon checking in, the front desk member told me I was eligible for either a bigger room or a room on a higher floor with a view. I opted for the bigger room for the extra space it provided to exercise.

Beyond that room upgrade, I also received later checkout times between 12:30-2 p.m., though this is not nearly as helpful as the 4 p.m. checkout offered as a standard benefit to Globalists (World of Hyatt’s highest tier).

You also get free Wi-Fi at hotels even as just a member of a program, so it’s always worth signing up.

Read more: What is World of Hyatt elite status worth in 2022?

Otherwise, I haven’t noticed much of a difference with this entry-level hotel status.

As I continue frequenting Hyatts, I look forward to earning more perks, like the free breakfast that my Globalist friends receive. Higher-tier members also sometimes get costly resort fees waived and receive complimentary parking on free night awards.

I am loving earning World of Hyatt points, and I like that I have the opportunity to earn milestone rewards including two Club Lounge Access Awards after I stay 20 nights in a calendar year. I am a World of Hyatt Discoverist which you qualify for after 10 eligible nights (or when you accumulate 25,000 base points or $5,000 in spending) or by holding the World of Hyatt card and/or the World of Hyatt Business card. Both come with automatic Discoverist status.

There are ways to contribute to status beyond credit card spending

Because I want even more rewards as an American Airlines AAdvantage loyalty member, I’m attempting to become an AAdvantage Platinum. For me specifically, I have to look at ways to qualify for status beyond co-branded credit card spending alone.

I was pleased to learn that I could earn both the airline’s Loyalty Points and AAdvantage miles through an activity I already participate in — online shopping. Yes, you read that correctly. You can use the American Airlines eShopping Portal to shop and earn a certain number of miles per dollar at select retailers you might already frequent, such as Lululemon, Alo Yoga, Walgreen’s and Nordstrom Rack.

Another easy way to reap the benefits of activities you already participate in is by linking your credit cards to the AAdvantage Dining program. This allows you to earn between 1 and 5 AAdvantage miles per dollar spent at participating restaurants for both dine-in and takeout service.

The number of miles you earn correlates with your level of participation. For example, a VIP member earns 5 miles per dollar spent when they make 11 transactions in a calendar year through the program. All members get 1 mile per dollar spent.

For additional ways to earn AAdvantage miles that don’t involve flying or using an American Airlines co-branded credit card, see our guide here.

Link your AA and Hyatt accounts

Once I became an American status holder, I started targeting Hyatt hotels specifically. This wasn’t a random choice — American and Hyatt elites can link their accounts to get reciprocal benefits thanks to a partnership announced in 2019.

This means I can earn 1 AAdvantage base mile per eligible dollar spent on qualifying Hyatt stays and experiences, and 1 World of Hyatt bonus point for every eligible $1 spent on qualifying American flights. This is in addition to the points and miles I would earn on stays and flights, respectively.

To take advantage of this double-dipping opportunity, you must link your World of Hyatt and AAdvantage accounts.

Read more: Chasing American Airlines elite status? Here are 14 ways to earn Loyalty Points

Always charge your hotel meals to your room

Speaking of hotels, I learned something very valuable from TPG executive editor Scott Mayerowitz, which is to charge everything you buy at a hotel to your room.

I learned this lesson in December when dining with my aunt at Rita’s Cantina, a restaurant at the JW Marriott Scottsdale Camelback Inn Resort & Spa. As I got out my credit card to pay for my portion of lunch, Scott walked by and said, “What are you doing? You should be charging that to your room.”

The reason you should charge any restaurant bill to your room is that doing so will earn you more points with the hotel than if you just used any old credit card to pay for the meal. You should put all parts of a hotel stay, from the room itself to meals to any extra services, on your room bill.

Not only does this tactic allow you to earn more points, but it also could help you reach the highest levels of status.

In this case, it might help you reach their top-tier Marriott Bonvoy Ambassador status which requires $20,000 of spending each year to earn in addition to 100 nights with the chain. Every dollar (in spend) counts.

Related: What is Marriott Ambassador status worth?

The value of Chase Ultimate Rewards points

In addition to learning about hotel and airline status, another big takeaway for me during my time at TPG is how to determine the value of Chase points.

Right after I started at TPG, my coworkers convinced me to take advantage of the then-100,000 point offer for opening a Chase Sapphire Preferred Card. I earned that bonus (the card now offers a still-decent sign-up bonus of 80,000 points) but it has taken me the subsequent nine months to earn an additional 16,000 Chase Ultimate Rewards points.

For the first time in my life, I closely looked at just how valuable the points actually are.

Chase values its Ultimate Rewards points at 1.25 cents each, meaning I could redeem these points for use on travel costs through the Chase travel portal for as much as $1,450 in bookings directly on the site.

However, based on TPG’s most recent valuation of Chase points at 2 cents each, these points could be worth even more with the right redemption or transfer. TPG values my points around $2,320.

This confused me at first, because I didn’t understand how Chase could value its points one way and TPG could do it another. The reason for the difference in valuation is that you can often reap a higher value out of the points by transferring these points to travel partners instead of using the Chase portal, a move that has the potential to get you outsized earnings.

“As for value, it’s all in how you plan to redeem,” said TPG senior reporter Katie Genter, who continues to be one of the most valuable TPG resources for points and miles newbies like me.

For example, Chase users may see the value of Ultimate Rewards increase when they transfer the points to partners like World of Hyatt.

Related: Hilton, Marriott and other loyalty programs are offering free points for new members

So does having Ultimate Rewards points mean you automatically have World of Hyatt points?

“Kind of,” Genter said — but like all things points and miles, there’s no short answer to this.

You can transfer Chase points to Hyatt at a 1:1 ratio, but that doesn’t work in reverse. Some partners are more valuable than others based on how far a point goes. For example, you’re likely to get more value from one Hyatt point than one IHG point.

Alternatively, you could use Chase points to book a Hyatt stay through the travel portal. However, you’d only get 1.25 cents per point when doing so, and you wouldn’t get any elite earnings or benefits (which are only granted by booking through the hotel directly).

So, it would be more beneficial to transfer Chase Ultimate Rewards points to Hyatt and then redeem those World of Hyatt points for your stay (unless the points rate is very high or the case rate is low). This is where the TPG calculator is helpful.

The calculator is your best friend in determining whether you should use points or cash for a flight or hotel.

Personally, I haven’t yet used my Chase Ultimate Rewards points, as I’m saving up for a bucket list trip. I’ll be sure to update readers once that happens.

Pick a credit card that rewards your spending habits

When I dove into the world of Chase Ultimate Rewards points, I took a closer look at my spending habits to see what I was actually spending money on.

Based on that research, I decided it would be worth looking into another card that rewards everyday spending. It sometimes makes sense to use different cards for specific purchases. This is one of the many tips I learned from TPG senior reporter Benji Stawski.

I like the Chase Sapphire Preferred for the 2 points per dollar on all travel and so-called “personal” purchases, which is helpful as I spend a lot on travel purchases, including Uber.

I also spend consistently on food, namely groceries from Whole Foods. Because of that, I plan to get the American Express® Gold Card, which would give me 4 points per dollar on dining (including takeout and delivery) and 4 points per dollar on up to $25,000 in groceries per calendar year.

Cardholders also get a $10 monthly credit to use toward Uber, as well as credits on other partners, including Seamless and some Shake Shack locations — a personal favorite for me.

For non-bonus and non-everyday spending, I’m looking at the Chase Freedom Unlimited®, which has no annual fee and would offer up to 1.5% cash back on purchases.

Related: Get more from your points with these 5 transfer bonuses

As you can see, it makes sense for some people to have multiple cards.

Always compare flight prices in cash versus miles

As previously mentioned, you shouldn’t always assume that using points or miles instead of cash is the way to go, especially for limited-time flight deals.

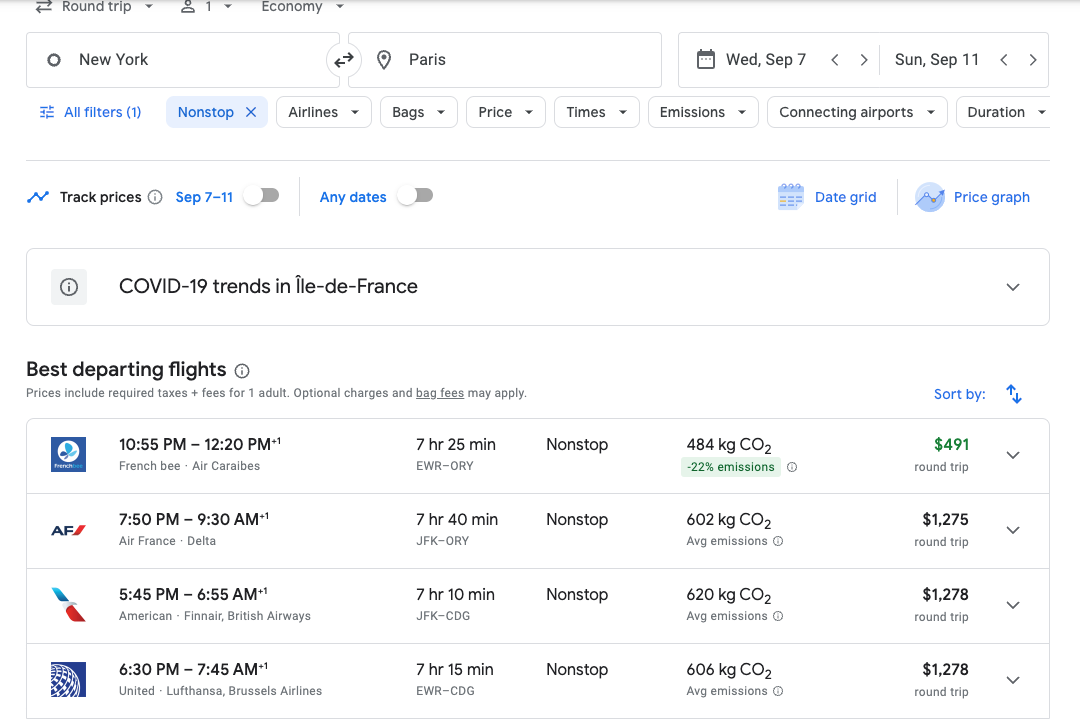

For example, let’s say you are considering a flight to Paris this fall. Google Flights tells me the average economy flight from the New York City area to both Paris airports — Paris Charles De Gaulle Airport (CDG) and Orly Airport (ORY) — in September costs about $1,200. There was one exception from French Bee, a low-cost carrier that costs just less than $500.

At this point, you should consider what you’d get in return for a significantly lower price tag of $491. For some, the thought process may end here; since French Bee doesn’t have a mileage program, there’s no miles redemption to consider.

However, if I was considering this flight, I would tell you that you get what you pay for based on my experience recently flying French Bee’s inaugural Los Angeles International Airport (LAX) to ORY route. Therefore, I am going to calculate the value of the other available flights.

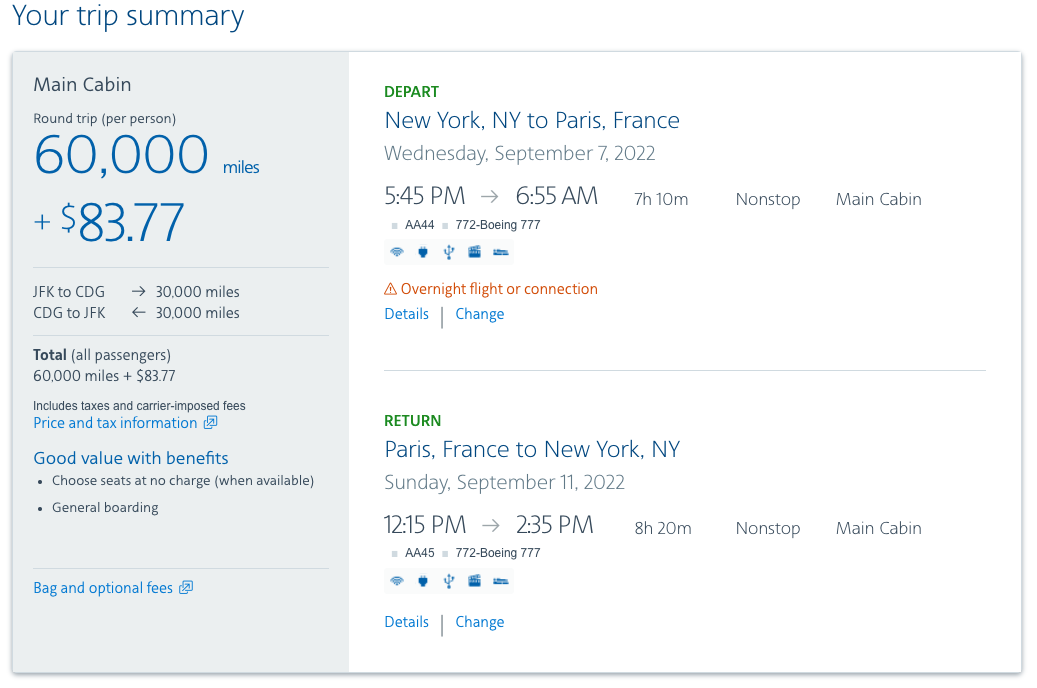

Since I am attempting to reach American Airlines status, I’d first look at the cash price of the American flight, before determining how much the same flight would cost in miles. In this case, it would be 60,000 AAdvantage miles plus $83.77 in taxes and fees.

Read more: Never say never: I just got upgraded as a lowly AAdvantage Gold member

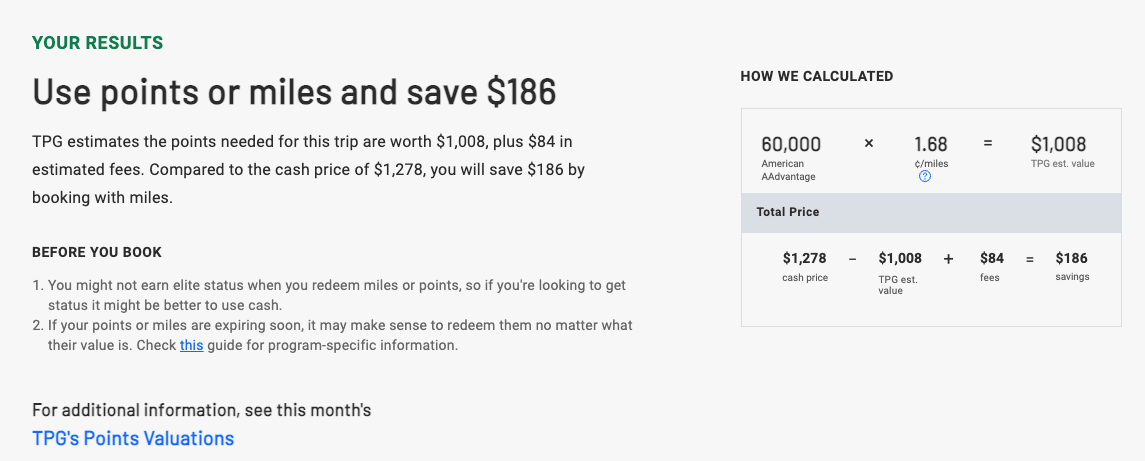

With the cash and miles price in hand, I headed to our calculator to compare how much money I would save by using cash versus miles to book this flight. Based on TPG’s current valuations, which peg AAdvantage miles at 1.77 cents a piece, I would actually save $186 by booking this flight with miles. This doesn’t take into account the number of Loyalty Points you would earn for the cash booking (in my case around 8,400 Loyalty Points). Your mileage may vary.

Be sure to bookmark the TPG calculator for your future use.

Compare the value of booking through an airline versus booking with a transfer partner airline

As you go through the process of booking flights, you should also see whether there’s an opportunity to transfer miles from a rewards portal to book with another airline that may be a better value.

For example, I can use AAdvantage miles from flying American-operated flights to book award tickets on other Oneworld alliance carriers, but I can’t transfer those miles between partners.

You should compare the partners to see which can offer you the best value.

For instance, while you can book trips on Oneworld partner airlines such as British Airways and Japan Airlines using AAdvantage miles, you may be better off transferring Chase Ultimate Rewards points directly to British Airways for that redemption.

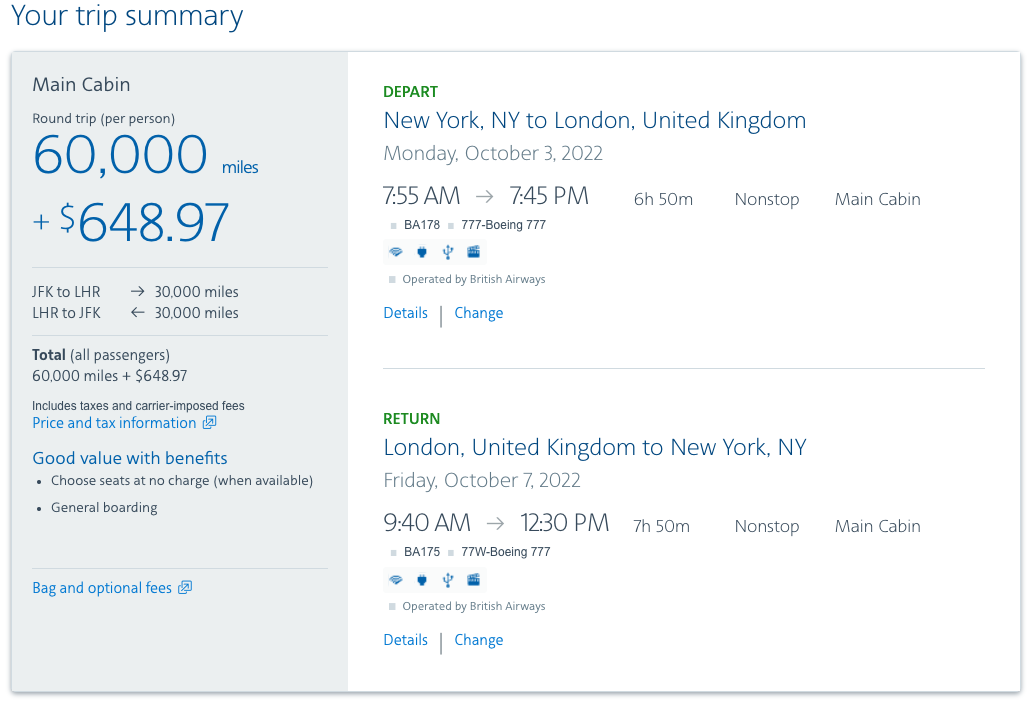

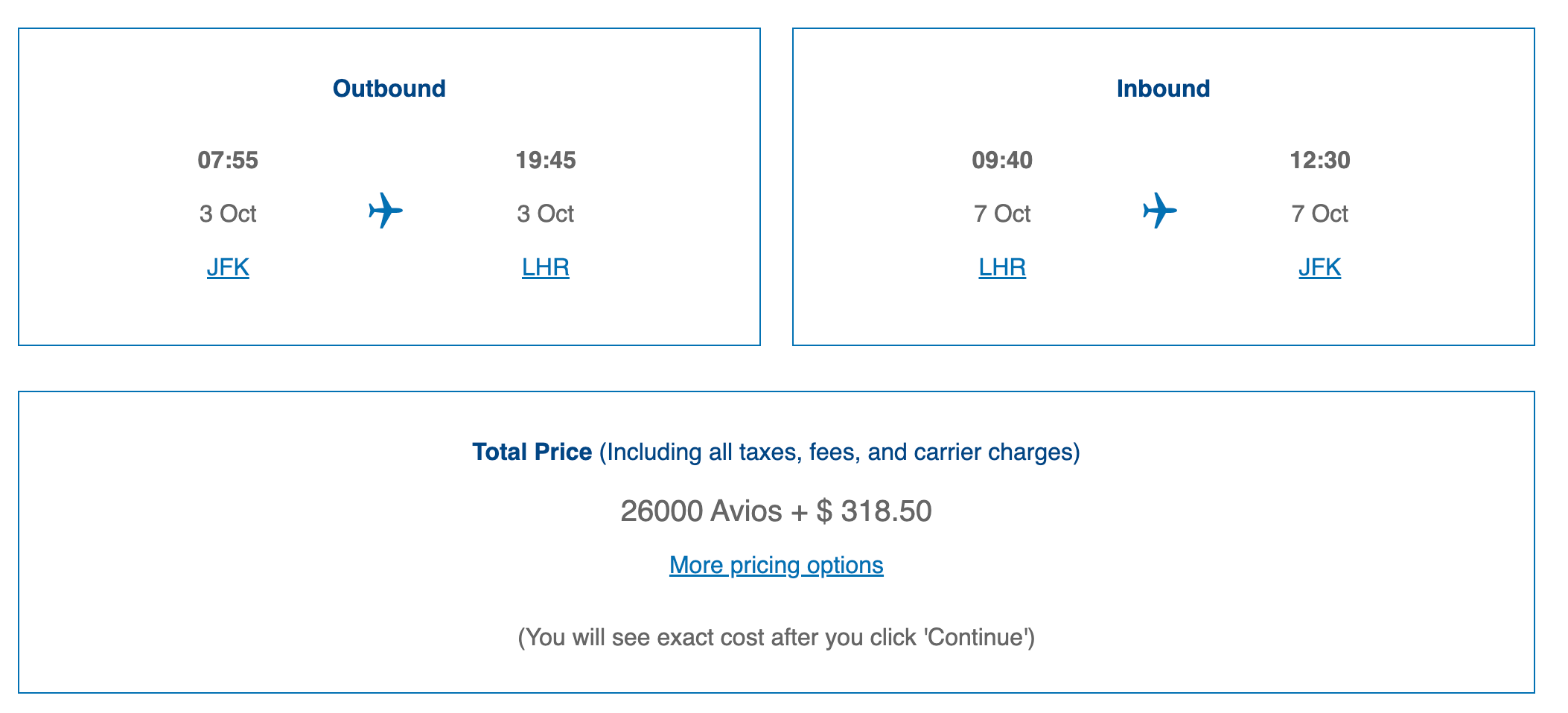

Here is just one example to compare how much it would cost to use miles to book the same flight through American versus British Airways.

A round-trip main cabin fare from John F. Kennedy International Airport (JFK) to Heathrow Airport (LHR) booked through American would cost 60,000 AAdvantage miles plus approximately $650 in fees. That same flight booked through British Airways would cost only 26,000 Avios plus $318.50 in fees for the economy cabin. In this case, it would make more sense to use British Airways miles versus AAdvantage miles.

And while it appears that using miles is the way to go here, let’s run these numbers on the calculator to make sure. Indeed, you would save $316 by using AAdvantage miles or $633 by using Avios. Therefore, transferring using Avios, in this case, is a better deal.

A good rule of thumb for transferring points is that you only want to do so when you have a specific redemption in mind. There are also times when a transferable currency program offers a periodic transfer bonus period with a deadline to transfer the points; this can yield lucrative points redemptions.

Read more: Get more from your points with these 5 transfer bonuses

Bottom line

As you have read, there is a lot to learn when it comes to points, miles and loyalty. You have to treat it like a game and turn it into a hobby to really make it work since there’s not one single credit card, loyalty program or method that will solve every travel problem.

Related: Here’s why American’s new Loyalty Points are a game changer for me

Here’s my biggest takeaway: It’s complicated. TPG is in the business of making it easier, but I can tell you firsthand it’s not easy. The rules are also constantly changing, so you need to do your homework. It’s something that you really need to study to fully maximize, but the more you learn, the more you’ll benefit. It’s simple to get free travel — even if you are not an expert — by following just a few of the tips I’ve gone over in this story.

Featured photo by Caroline Tanner/The Points Guy.